Contents

Cash-out refinances represent an increasingly larger portion of all fha-insured refinance transactions. “This further adjustment to its maximum LTV requirements will permit FHA to mitigate this.

Cashing Out Meaning Cash Out Home In June, just 16% of home buyers paid in cash, down from 23% in February, according to the National Association of Realtors. The rest bought the old-fashioned way – by taking out a mortgage.Cashin Out Lyrics: I’m ridin’ round wit that Nina / You know we smokin’ on Keisha / Hey, hey, hey can I meet ya? / Cut it up / Cool / 36 Os so riding round with that nina / Riding with a ho namedTexas Cash Out Refinance Calculator Cash-Out Mortgage Refinance Calculator Texas – Mortgage Brokers & Lenders Directory You can search our directory or Mortage Brokers & Lenders and get a current quote on 30 year fixed mortgage rates as well as current mortgage interest rate for other loan programs.

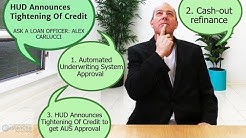

In Mortgagee Letter 2019-11, the U.S. Department of Housing and urban development (hud) announced that it is reducing the maximum loan-to-value ratio and combined maximum loan-to-value ratio on cash-out refinance mortgages from 85% to 80%.The change is effective for case numbers assigned on or after September 1, 2019.

"Especially for millennials who may have a hard time saving up enough money for a 20% down payment, FHA Loans are a popular option.” And while FHA rules and guidelines have changed. “You also can’t.

"Especially for millennials who may have a hard time saving up enough money for a 20% down payment, FHA Loans are a popular option.” And while FHA rules and guidelines have changed. “You also can’t.

Our opinion is established according to our Environmental, Social and Governance ("ESG") exclusive assessment methodology, and to the International Capital Market Association’s Green Bond Principles.

per HUD Handbook 4000.1. M&T Bank Correspondent is requiring the following seasoning requirements, effective immediately, for all new VA Refinance & FHA cash-out Refinance registrations: The borrower.

Mortgage Refinance With Cash Out No Pmi Mortgage 2016 How to Get a Mortgage With No Down Payment | U.S. News – How to Get a Mortgage With No Down Payment. First-time buyers between July 2016 and june 2017 typically financed 95 percent of the purchase price, according to the Aspiring Home Buyers Profile data.. Fifth Third Bank offers a zero down payment mortgage with no private mortgage insurance to.Got a 30-year mortgage? Refinancing it as a 15-year loan will. If you’re in a similar situation, by all means direct your extra cash into retirement accounts or other investments and let the.

Qualify for an FHA loan with little or no equity, lower credit scores and more debt.. limits if it meets certain guidelines, especially if you're refinancing an existing FHA loan or. Nor is streamline refinancing a way to get cash out of your home.

NOTE: These guidelines include overlays, which may be more restrictive than FHA requirements. A thorough reading is recommended. program qualifications Impac’s FHA standard refinance (cash Out) is designed for the cash out refinance of owner occupied single family residences using an FHA insured home loan.

Conventional Cash-out Refinance. LEW SICHELMAN: Sorting out the mortgage after a divorce – "This has a huge advantage, especially when a property has declined in value or has not gained enough equity for a normal FHA cash-out refinance. guidelines. And in no case can he or she receive.

If you don’t have a lot of cash for a down payment. Aside from that, one realtor told me that FHA loans can make inspections hairy. Once you make an offer on a home, inspectors come check it out.

With the Depression holding down its cash flow. it was not backing junk, the FHA issued the first nationwide standards for.

Refi With Cash Out Cash Out Refinance Calculator – Discover Card – A cash-out refinance is when you take out a new home loan for more money than you owe on your current loan and receive the difference in cash. It allows you to tap into the equity in your home. Cash-out refinancing makes sense: